|

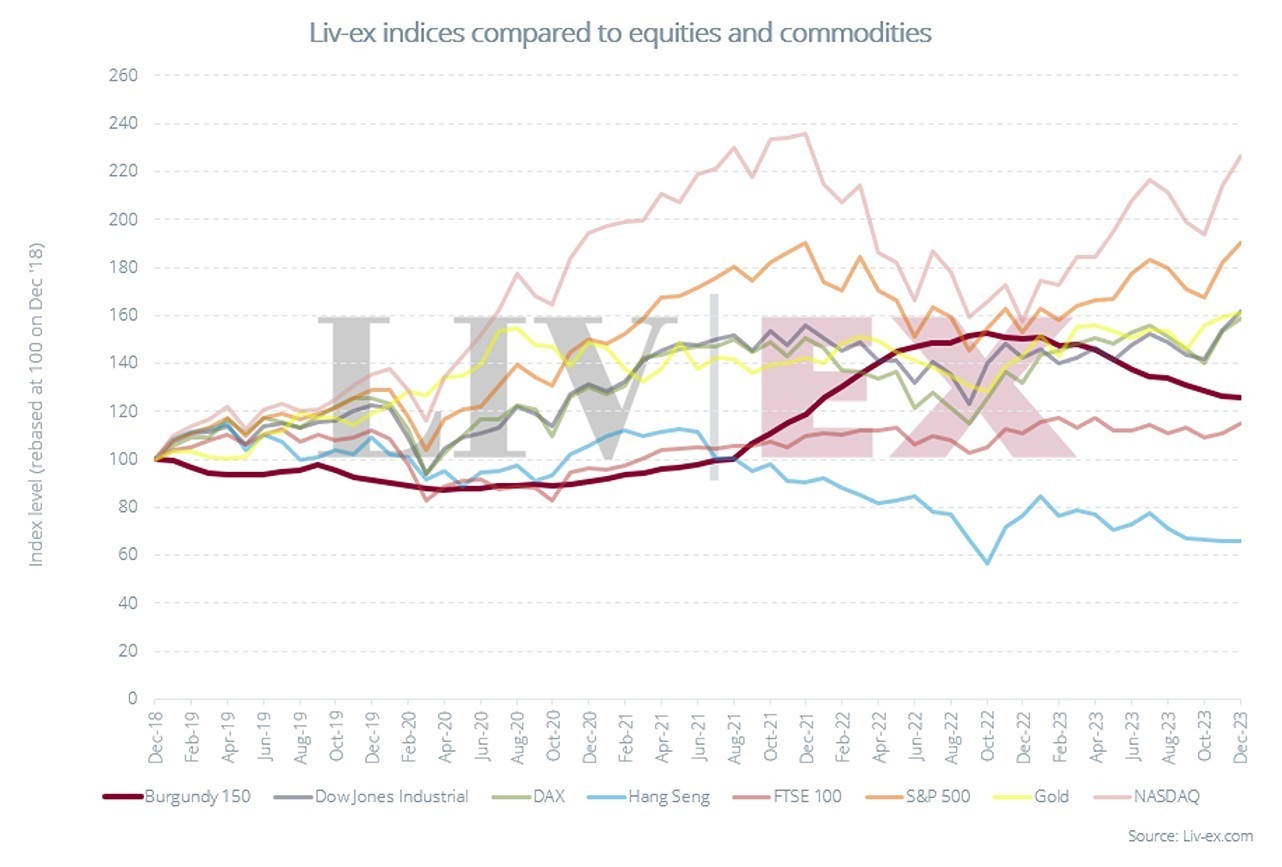

The almost 20-year price upswing for Burgundy on the secondary market came to an end in October 2022. As the global wine trading platform London International Vintners Exchange (Liv-ex) published in a recent report, its Liv-ex Burgundy 150 Index has fallen by 17.4 per cent since then. This is significantly more than the Liv-ex Fine Wine 100 Index, which tracks the world's most traded top wines. The Liv-ex Burgundy 150 Index has also become significantly less attractive since October 2022 compared to other forms of investment (see image).

After the very small harvest volume in 2021 due to weather influences, which led to price increases, 2022 brought good qualities in sufficient quantities. For the first time in ten years, average yields of over 40 hectolitres per hectare were achieved again. In addition, cool nights preserved the acidity in the grapes, resulting in high-quality wines.

Nevertheless, prices on the secondary market fell. According to Liv-ex, the 2021 Burgundy En Primeur campaign may have "tipped the scales". The fact that most wines were sold out despite their high prices is not so much due to increased demand, but rather to the small quantities available. While Burgundy was still the fastest growing region on the secondary market in 2022, the trade value of Burgundy wines fell by almost 32 per cent in 2023. The volumes traded fell by 31 per cent from their peak in March 2023 to December 2023. There were clear differences between Grand Crus and wines from village appellations: The volume of Grand Crus also fell by 32 per cent compared to 2022, while that of Village wines fell by only 15 per cent. The increasing popularity of village wines is also evident in a longer-term comparison: over the past seven years, the volume of Grand Crus traded has risen by 33 per cent and their commercial value by 124 per cent. In the same period, the volume of Villages increased by 23 per cent, while their value rose by 222 per cent.

"The ratio between bidders and supply in Burgundy is the lowest among the most important regions on the secondary market," write the Liv-ex analysts in their report. This points to increased risk aversion - and is a sign that the current price correction will continue, primarily due to economic and political uncertainties.

(al / Source: Liv-ex)