|

The Liv-ex 100, the industry's leading benchmark for tracking global fine wine prices, was down 2.9 per cent month-on-month in June and 6.1 per cent year-to-date. The Champagne 50 index even lost 10.3 per cent since the beginning of the year. The Rhône 100 index is the weakest single index so far in 2023, down 15 per cent.

Bordeaux had a 41.6 per cent share of total trade by value in the second quarter; in 2022 it was 35 per cent. Wines from Tuscany and Burgundy also gained market share, in contrast to Champagne, Rhône, Piedmont, the USA and "others".

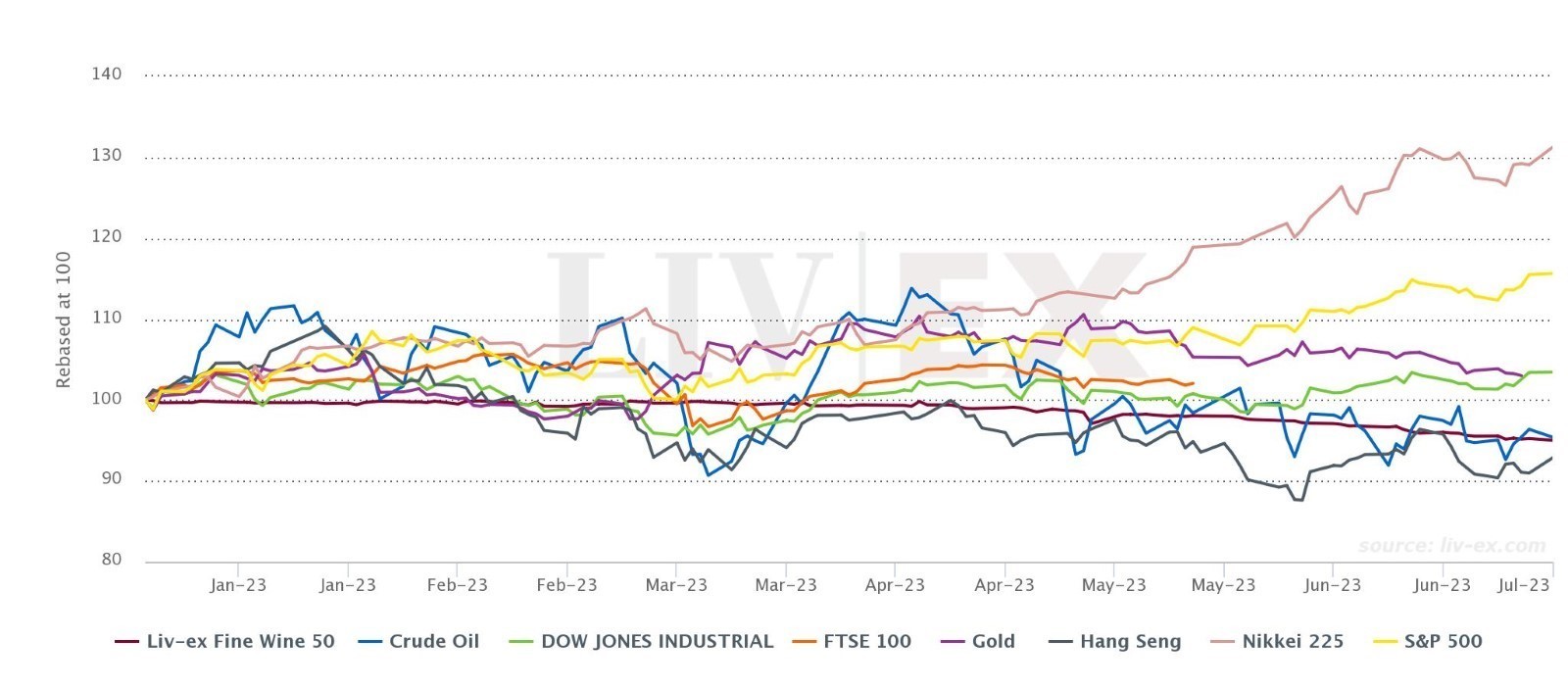

Although the Bordeaux En Primeur 2022 campaign took place in the second quarter, the Bordeaux indices suffered further declines. Sales fell short of the 2020 vintage in terms of both value and volume. Liv-ex had criticised early on the partly enormous price increases for the 2022s, which would have scared off many buyers, especially since very well rated wines from 2018 - 2020 are still easily available. According to Liv-ex, investors currently prefer to put more of their money into stocks that have performed positively over the course of the year and are already warning of problems for the 2023 campaign, whereby all but the large and famous châteaux could have problems placing their wines in sufficient quantities.

(al / Source: Liv-ex )