Prof Simone Loose from Hochschule Geisenheim University expects major challenges for the wine industry this year: "The trend of declining consumption will not disappear, even if the economy picks up again"

Geisenheim UniversityDeclining wine consumption will lead to significant changes in the industry. Despite the major challenges, the ProWein Business Report 2023 sees a "silver lining on the horizon".

Too much, too complicated, too unprofitable. These are the findings of the ProWein Business Report 2023, which was compiled by Prof Simone Loose, Director of the Institute of Wine and Beverage Business at Hochschule Geisenheim University, on behalf of ProWein. For this sentiment barometer, she surveyed 2,000 members of the wine industry, including producers, exporters, importers, specialist wine retailers and representatives of the catering and hotel industries in the most important wine-growing countries in Europe and overseas.

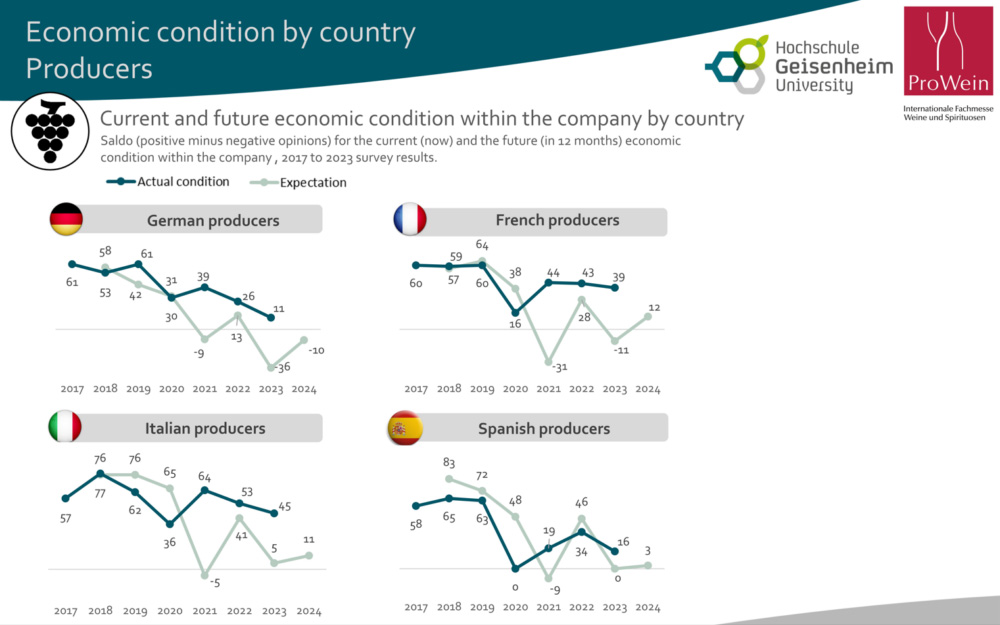

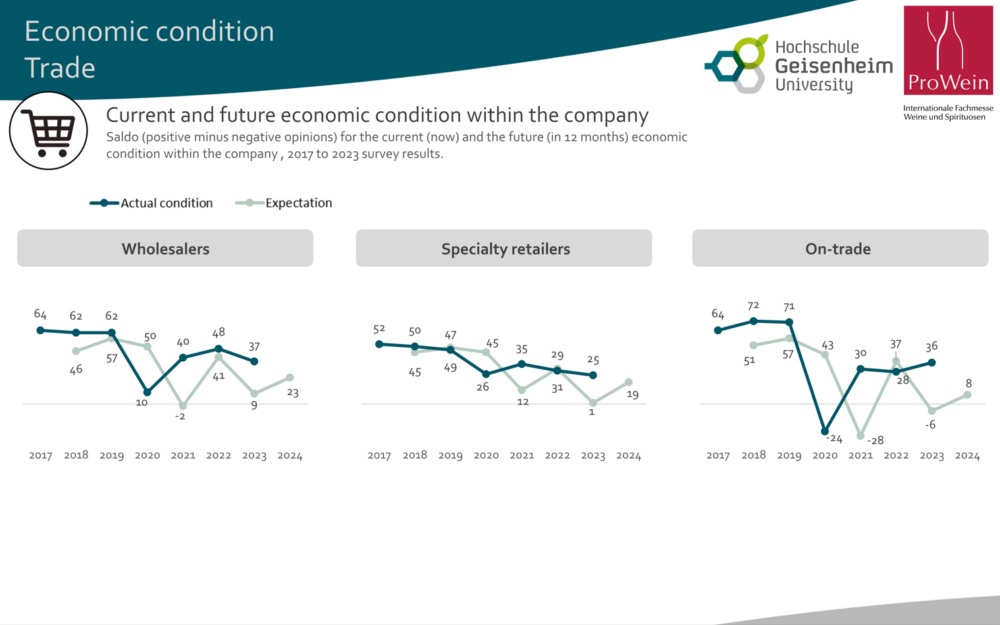

The global economic situation is still considered to be fragile. 59 per cent of respondents were concerned about the global economic downturn, almost half about the decline in wine consumption - in 2022 it was still less than a third. Almost three quarters cited cost increases as a threat to their business, a slightly lower figure than the 85% who did so in 2022. Supply chain issues were cited significantly less often as a problem - however, the survey took place before Houthi rebels almost paralysed the Red Sea and Suez Canal for shipping, leading to further problems and price increases in global logistics.

Two out of three companies and wineries have improved their cost structure. Every second wine merchant has reduced their portfolio by discontinuing unprofitable wines - which at the same time increases the competitive pressure on producers, exporters and importers. 54 per cent of retailers and 60 per cent of producers recorded lower profits in 2023. However, hardly any staff were cut due to the labour shortage. Loose describes the situation as follows: "Labour is scarce, so people are trying to keep it as long as possible."

|

|

Producers and retailers expect a slight improvement in the economic situation ©hsgeisenheim

The only market segment to record growth in 2023 was that of affordable and popular wines. Premium wines lost twelve per cent and mid-range wines seven per cent. On the other hand, the basic segment grew by twelve per cent. According to the business report, this trend will continue, albeit to varying degrees depending on the region. Among wine producers, all three segments lost slightly.

The regions in which the trade reported the greatest decline in premium wine sales are North America (USA and Canada) with minus 42 per cent and Scandinavia (Finland, Denmark, Norway and Sweden) with minus 43 per cent. The most significant growth in the popular segment was recorded in the Netherlands (20 per cent), Austria (18 per cent) and Switzerland (15 per cent). German retailers lost eleven per cent in the premium segment and five per cent in the mid-range segment, while basic wines grew by 13 per cent. The authors of the study expect this trend to intensify over the next two years. Only less than 40 per cent of those surveyed still see good chances of success for an exclusive premium strategy.

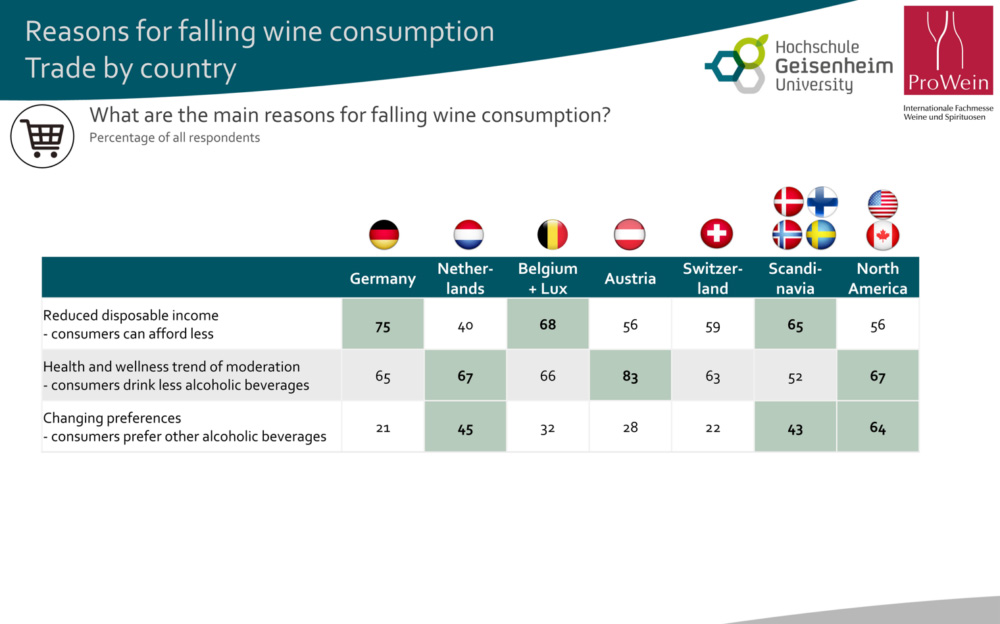

One of the main reasons cited for the decline in wine consumption is consumers' lower disposable income. Health trends are also prompting many consumers, especially younger ones, to either give up alcohol or switch to drinks with a lower alcohol content ("NoLo" movement). However, the wine industry could also benefit from this with a wider range of dealcoholised products, write the Geisenheim market researchers. However, other beverages such as beer and spirits are proving to be an even greater threat to wine community, which are growing significantly at the expense of wine, particularly in North America, Scandinavia and the Netherlands.

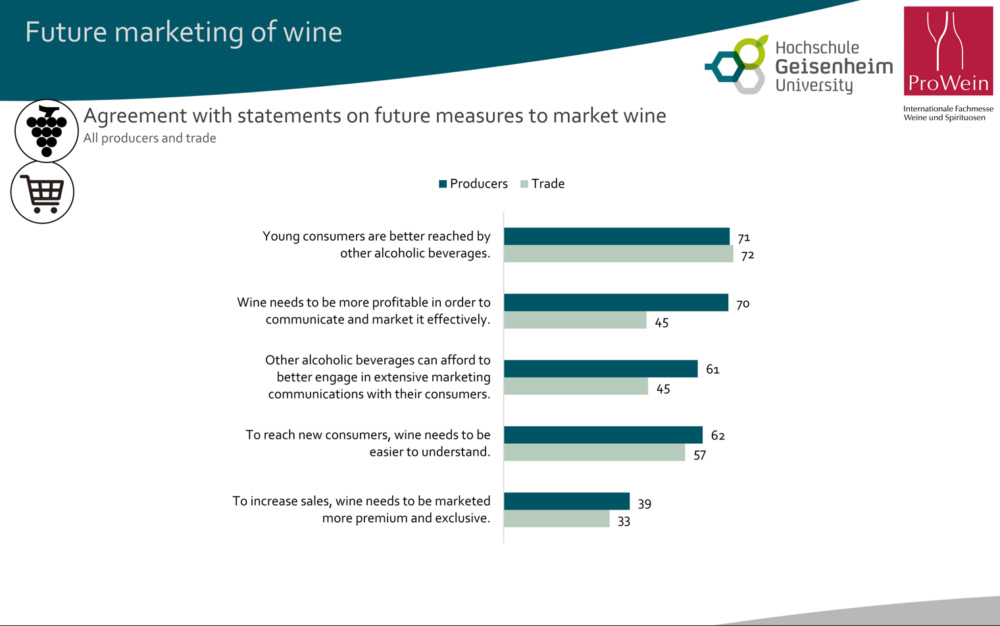

Loose explained that "big players" in the global alcoholic beverage industry have an advantage over many wine producers due to their significantly larger advertising budgets. 91 per cent of French wine producers surveyed for the report said that other alcoholic beverages could better reach younger consumers. This view is shared in most producer countries - with the exception of Austria.

The conclusion of the ProWein Business Report is that the industry must do everything in its power to capitalise on the health trend and bring alternatives such as "no-and-low" wines to technical and sensory maturity so that they are perceived by retailers and consumers as a serious alternative to wine. "The trend of declining consumption will not disappear when the economy picks up again," emphasises Prof. Loose.

|

A clear majority of industry experts are also in favour of making wine easier to understand in communication. Other alcoholic beverages have a less elitist image and therefore reach young consumers in particular better. In order to be able to compete with the marketing expenditure of other drinks, wine must become more profitable again. Only a small part of the industry continues to focus on marketing wine as an exclusive premium product.

A simplified communication strategy will have an impact on wine law and thus on winegrowing policy. According to the Business Report, geographical demarcations will become less important, as they would only appeal to very interested wine fans anyway. Loose therefore demands: "Don't copy the AOC system, it has no future". This sheds a new light on the current discussions in Germany and Austria about classifying vineyards according to the Burgundy model. Instead, retailers and producers need to agree on new concepts that are understandable to customers in order to reach new target groups.

|

Despite the fact that wine consumption has been falling for years, production areas and quantities have remained the same until recently. This has led to a global oversupply. Three quarters of producers are therefore observing an imbalance in the market, which is to the detriment of grape and bulk wine prices.

However, due to long-term investments in equipment and machinery, producers are tied to their vineyards for decades. The result is ruinous price competition for many businesses. The majority of producers are therefore in favour of reducing the oversupply by closing down vineyards or using the vineyards for other purposes. Almost 50 per cent of producers answered "yes" to the question of whether this would require state aid. However, just as many do not consider public support to be necessary.

Due to the already low profitability of the wine business, only a few see price cuts as a solution, especially in Spain and Germany, where bulk wine prices are already very low. Producers in France, Italy and Spain consider market-orientated campaigns such as targeting young consumers to be more promising. In any case, Prof Loose summarises the chapter in one sentence: "We need to produce less!"

Climate change is currently taking a back seat due to the difficult economic environment. The majority of industry participants also expect a slight improvement in the situation in 2024, a "silver lining on the horizon".

However, most are in no doubt about the major challenges facing the industry, which will mean major changes: Market streamlining, professionalisation, improved communication with new consumer groups. To achieve this, wine community must adapt its production structure, its product range and its communication to the needs of the present and the future. The report concludes that the faster this is achieved, the greater the share of wine in the consumer's beverage repertoire will remain,