In its half-year report, the global trading platform Liv-ex reports that the two-year downward trend in the fine wine segment is not yet over - even if there are few positive signs.

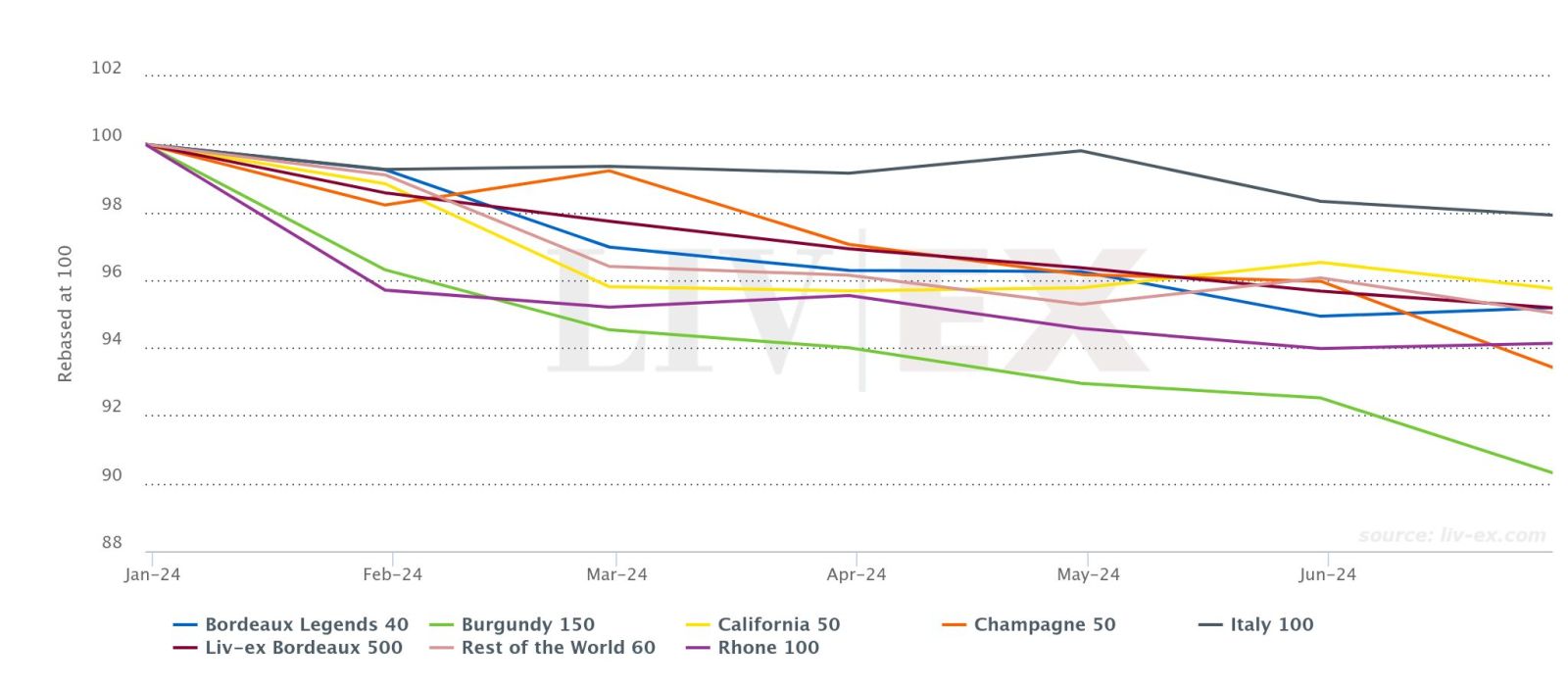

Liv-ex (London International Vintners Exchange), the global trading platform with 620 members from 47 countries, calculates the indices of the wines most frequently traded on the secondary market. The first half of 2024 was characterised by declines in all major indices. The Liv-ex Fine Wine 100, which tracks the 100 most traded top wines on the secondary market, fell by 3.4%, continuing the downward trend that began in autumn 2022. The index ended the first half of the year with a decline of as much as 17.9 per cent compared to its peak in September 2022.

Buyers and sellers are nervous and wondering when the bottom will be reached. There are now increasing signs that the market for premium wine could soon reach a turning point. In April, the Liv-ex Fine Wine 100 recorded its first positive movement in 12 months. In contrast, the important Bordeaux 2023 En Primeur campaign was disappointing despite an average price reduction of 22.5 per cent. It was also criticised by Liv-ex as being too low - because the 2023 Bordeaux were still 21 per cent more expensive than in 2021.

Looking at the components of the Liv-ex 1000 index, which tracks the price development of the 1,000 most important wines, differences can be recognised. Accordingly, the Italy 100, which records the prices of the past ten vintages of five Supertuscans and five top Italian wineries, has recorded the lowest losses of all seven sub-indices since the beginning of the year. It fell by 2.1 per cent. The California 50 was down 4.2 per cent. The Burgundy 150 lost 9.7 per cent and the Champagne 50 fell by 5.9 per cent. Liv-ex described the Italy 100 as "the face of resilience" by the end of 2023.

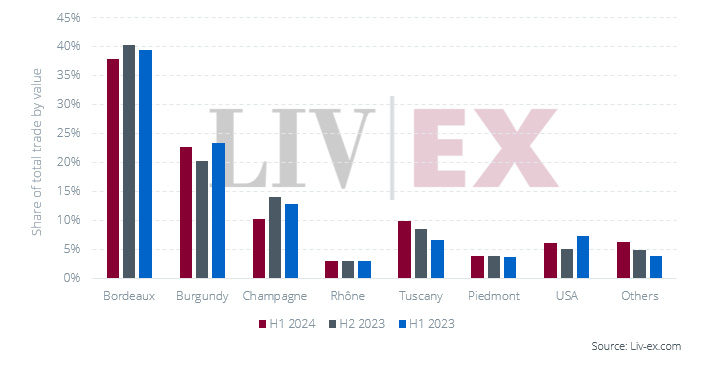

Bordeaux retained its leading position in the fine wine market in the first half of 2024. However, its share of the total retail value fell from 40.4 per cent in the second half of 2023 to 37.9 per cent.

At 22.7 per cent, Burgundy has a larger value share than in the second half of 2023 (20.3 per cent), but still less than in the first half of 2023 (23.4 per cent). Wines from Romanée-Conti, Emmanuel Rouget and Domaine Armand Rousseau in particular traded higher.

Champagne lost four per cent in value compared to the end of 2023 to just ten per cent. Many of the new vintages from the major houses were rated as "overpriced" by retailers.

In contrast, demand for wines from Tuscany has increased. They accounted for almost ten per cent of the traded value - compared to 6.6 per cent a year ago. Sassicaia and Tignanello accounted for the largest share.

Rhône and Piedmont remained stable at three and four per cent respectively. The USA increased by one percentage point to 6.3% compared to autumn 2024, after 7.3% a year ago. The "Other" category, in which Spain accounts for the largest share, rose from 3.9 to 6.3 per cent last year. This development was driven by Vega Sicilia, which has tripled its trade value and volume since the second half of 2023.

Trading values since 2023

Overall, the trade value in the first half of 2024 was 4.5 per cent lower than in the second half of 2023, which is far less than the 9.3 per cent decline between the first and second half of 2023.

Traded volumes remained almost stable in the first half of this year compared to the second half of 2023. Between the first and second half of 2023, they fell by 2.2 per cent. Bordeaux increased slightly again, as did Burgundy, Piedmont and "Other". The Rhône remained stable, Champagne lost a similar amount to the trade value (-4.4 per cent), Tuscany slightly, as did the USA. Wines from Spain, which belong to the "other" countries, overtook the USA with a share of 3.6 per cent of the volume.

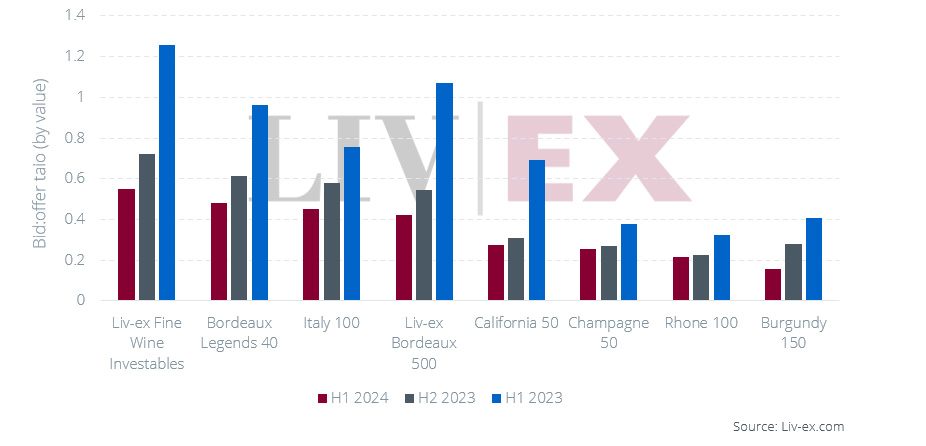

The ratio of bids to offers has fallen significantly since the first half of 2023 and remains low. The Burgundy 150 has the weakest demand. Only the Liv-ex Fine Wine Investables Index is at a value that indicates stability. This index is made up of several vintages of top Bordeaux wines, including Premier Crus and top wines from the right bank such as Petrus. Apparently, these wines give buyers sufficient confidence even during market downturns. The Bordeaux Legends 40 index with older vintages also recorded a slight increase in June.

Bid-offer ratios since 2023

The bid-offer ratios for Rhône, California and Champagne have remained relatively unchanged since the summer of 2023. This is interpreted as a sign that sentiment for these wines has hardly deteriorated and that they are - possibly - bottoming out. As Liv-ex writes in its report, this is "an encouraging sign in a market like today's".

In their outlook, the Liv-ex analysts write that they are confident. The price trend would still be uncertain and there would be a shift towards "safe havens" and "blue chips". Looking at the ratio of offers to bids as a measure of market sentiment, it can be assumed that confidence levels may have reached their lowest point. The stable volumes traded prove that buyers have not lost confidence in fine wine.