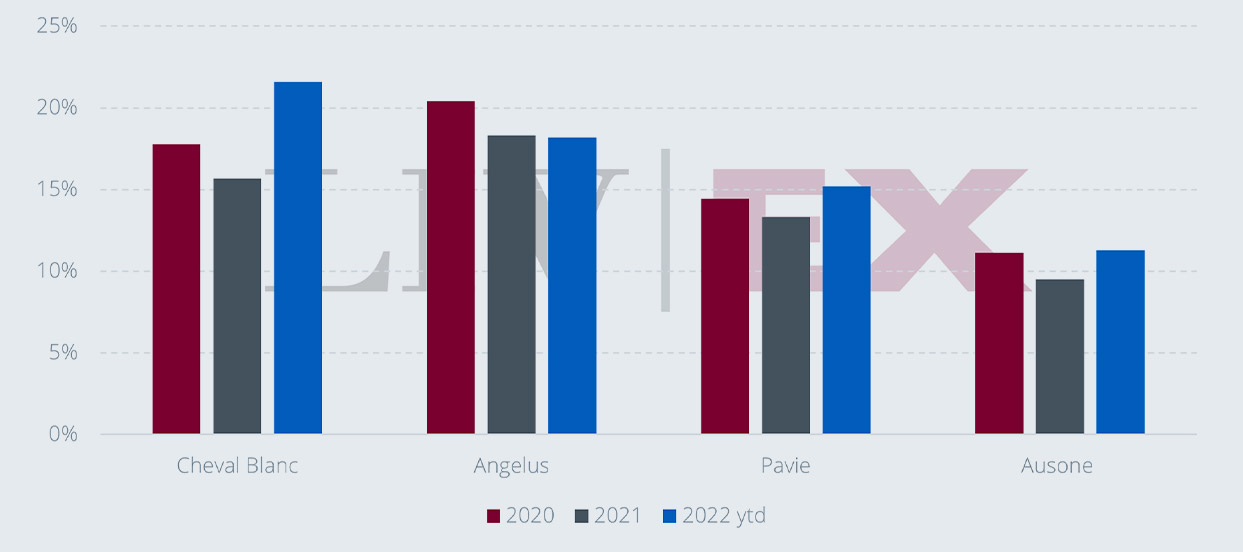

Year-to-date, Cheval Blanc leads trade within the appellation, replacing Angélus, which had the top spot in 2020 and 2021.

Pavie and Ausone have maintained their positions, while increasing their shares of trade on the last two years.

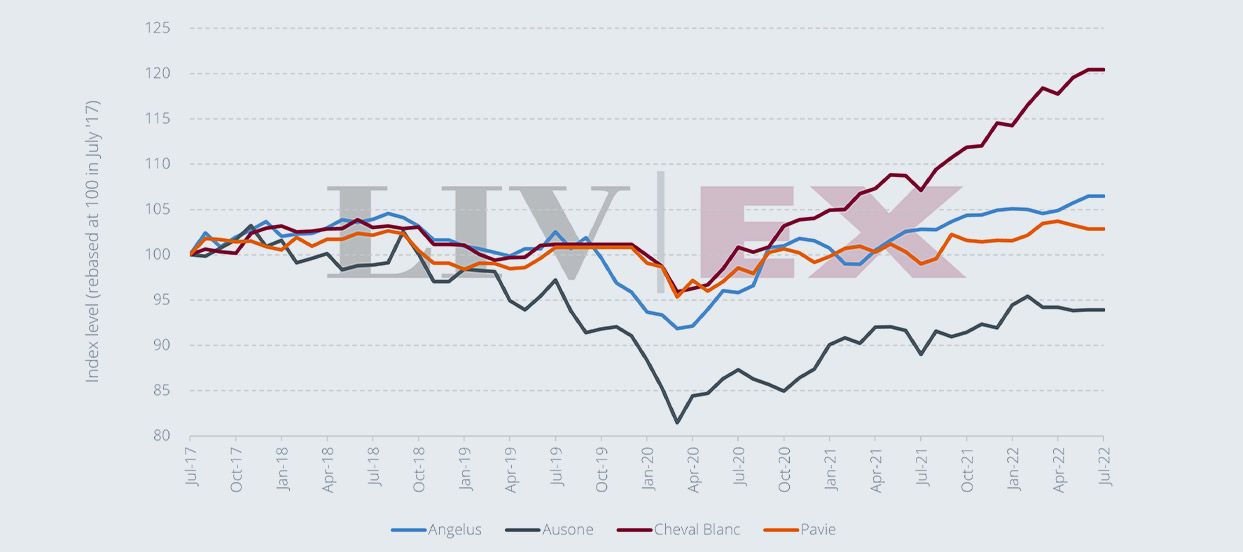

When it comes to price performance on the secondary market, there has been no discernible long-term effect for the three estates following their withdrawal.As the chart below shows, the Cheval Blanc and Ausone indices closed July 2021 down 3.0% and 1.5% respectively. However, they quickly made up for this dip. Meanwhile, Angélus went up 0.2% in January 2022, after announcing its exit.

In fact, Cheval Blanc has seen prices rise since the withdrawal announcement, helped (no doubt) by two well-judged releases in this year’s and last year’s En primeur campaigns which have cast a positive light on the brand.

As can be seen from the chart below, the Covid-19 pandemic seems to have had a greater immediate impact on the performance of these estates than any withdrawal announcements. All four estates saw prices fall much more sharply in the beginning of 2020, as borders closed and Asian buyers pulled back.

Cheval Blanc has recovered since then and prices have risen 20.4% on average over the last three years.

Likewise, Angélus has seen prices rise 6.5% and Pavie 2.9%. Only Ausone has remained in negative territory, down 6.1%.

However, looking back to 2017-2019 one can see that Ausone’s price performance was drifting even before the outbreak of the pandemic.

This article was originally published on Liv-ex, the global marketplace for the wine trade. Data within it reflects the independent, real-time buying and selling activity between hundreds of the world's most active and most reputable wine businesses. Discover the smartest way to price, buy and sell wine!