In the past ten years, the buying behaviour of wine lovers has changed radically. The Nielsen statistics from 2020 published by the German Wine Institute (DWI) show: German consumers buy two thirds of their wine in discounters (39%) or in LEH (27%). In addition, online wine trade has been increasing massively since the Corona pandemic. Nine per cent of all wine purchases in 2020 were made over the internet - eight per cent from pure online retail chains, Amazon and vintners with their own shops. The big losers in the industry, on the other hand, are the local specialist retailers: Last year, only five percent of sales went over the counter at traditional wine retailers. These trends were already apparent before Corona - and have now been accelerated significantly with the pandemic. A return to old habits is therefore unlikely.

This poses challenges for many stationary retailers and wineries: For the market for alcoholic beverages as a whole has not recorded any growth for many years. A cut-throat competition is raging in the industry - if online retailers increase their sales, less is sold elsewhere. In addition, German consumers are spending less and less money on wine and sparkling wine: This is confirmed by surveys conducted by the market research institute GfK and commissioned by the DWI. While total sales of alcoholic beverages remained stable at around 13.5 billion euros between 2015 and 2019, the share for wine and sparkling wine in sales fell from 43 percent to 40.4 percent. Which is easy to explain: the majority of all wines are sold through discounters at extremely low prices. Spending on spirits and beer, on the other hand, has risen. This reflects another trend: wine is clearly losing its appeal, especially among consumers between 18 and 34 years of age, in favour of other alcoholic beverages. This trend is confirmed by drastic figures from Great Britain: Ten years ago, the proportion of people in this age group who regularly drank wine was around 50 percent. By the end of 2020, it was only 24 percent. Similar developments can also be seen in Germany and Austria.

But what does this mean for winegrowers and retailers? How can they survive in the future? Wine marketing professional Diego Weber has the answers. He is the voice behind the Podcast „Wein verkauft!" and advises wineries on marketing and sales. Weber says with conviction: "The wine trade of the future will take place much more online. We are still at the beginning. The great advantage of the internet is that you can get in touch with countless people at the same time. Above all, vintners have to learn that they can build up reach and use it for direct sales. The new farm-gate sales is the internet." Weber points out that in the future even fewer consumers than today will fill up their boots at the vintner. According to GfK figures, only 12 percent of wines are sold at the vintner's farm - 20 years ago, this figure was many times higher.

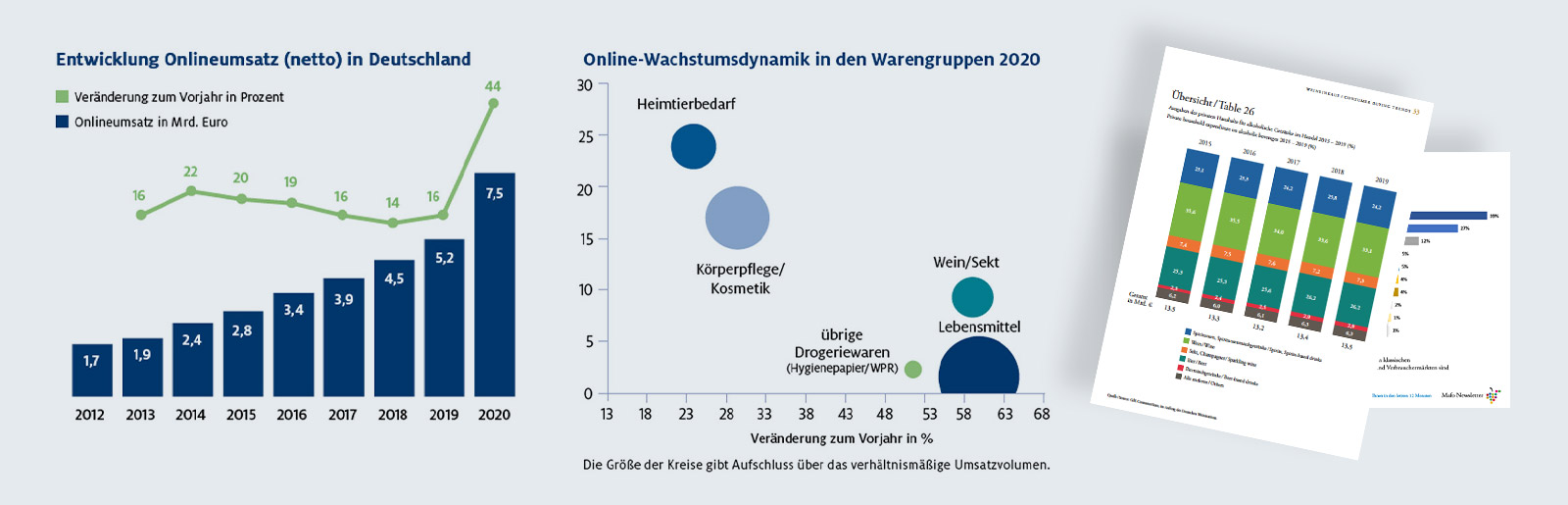

Weber's statement is supported by figures of the German Trade Association (HDE). According to their figures, the online turnover with food as well as products of daily use increased by 44 percent in 2020 compared to the year before to 7.5 billion euro. The share of the wine and sparkling wine product group rose from 6.2 to currently 9.3 per cent. That is an increase of a whopping 50 percentage points. All trend researchers agree: these increases will continue in the coming years.

The new farm-gate sale is the internet.

In order for winegrowers to get a piece of the internet pie, they need their own online shop. This is the only way they can secure the large margins they would otherwise have to give up to online traders, Weber emphasises. "Many smaller businesses don't even have a price calculation with which they can counter the large trade structures in the online business. And simply raising prices is not something that lesser-known wineries can afford," Weber explains the dilemma that many wineries face.

On-site tasting is not possible when buying online. What can winegrowers do to compensate for this? "You can offer introductory packages with six or twelve different wines for first-time buyers. But all merchants who sell wines online also have this problem," Diego Weber admits. Influencer marketing can help here. Because trustworthy people who make recommendations for wines are becoming increasingly important. But before vintners get into Instagram marketing, they would really have to understand what they are doing - and know their unique selling points. "They mustn't put the cart before the horse," Weber emphasises.

All winegrowers and retailers know that their customers also buy wine elsewhere. But whether they do so in the specialised trade or in discounters - who knows? "The real competition is not the winery next door, but Aldi," explains Diego Weber. This makes it increasingly important for specialist retailers to maintain personal contacts with their customers - even if the trend is moving online. But does the classic specialised trade always lose out in the current development? No, says Diego Weber. "A visit to a specialist retailer must offer something out of the ordinary and become an experience. Tastings, seminars, wine bars: The customer finds something there that he can't find anywhere else. This is the only way for the stationary retailer in the future to justify its existence." Even when it comes to buying special wines far from the mainstream, the specialist retailer focused on niche wines still has good chances.

Standing out from the crowd is indispensable.

Because the winning argument of the online trade is above all the price. The big web traders buy quantities that the small specialist trader around the corner can never buy. With lean logistics, the goods can be offered online at low, often unbeatable prices - often even without shipping costs. If the two sales channels compete with the same product, the specialist retailer loses out. That's why it's important to stand out from the crowd, to be extremely specialised. "If you offer a little bit of everything, you don't stand a chance in the future ", says Diego Weber.

|

But when it comes to wine, other people value personal contact very much, which is why many customers prefer the shopping experience in the shop to the emotionless internet ordering. For many, wine is not simply a consumer good. The opportunity to talk shop with the salesperson and get information on the spot is a clear advantage for the specialised trade.

But the biggest advantage of the classic wine merchants is the chance to let customers taste the wines. This offers especially less informed wine lovers the opportunity to deal with the matter not only online, but directly and with the palate. This creates a completely different appeal for him than just the description on the net.

In recent years, many specialist retailers have set up an online shop alongside their shop, in many cases rather improvised and born out of necessity. However, the saying "cobbler stick to your last" also applies in the wine industry. If the specialist retailer knows how to use his strengths, he will not have to fear for his existence. If they try to imitate the online shop and go in two directions, it could backfire. Because both forms require specific professionalism, capital - and a lot of time.