|

One of these raw materials is gold. For thousands of years, gold has been a much-loved commodity. An investment in gold is also often seen as a hedge against inflation and economic uncertainty. And we have plenty of that at the moment. Many of you will have seen that gold experienced a price correction of about 15 percent this summer. Because of this price correction, gold currently offers exciting entry levels. The opportunities are even more obvious with gold mining companies, some of which can currently be had at a fraction of their value. But here, too, it is important to find the right gold mining company. It is very important that the gold company has at least one value study prepared by independent experts. Now one gold company in particular has come into our focus.

|

Before you read on, we recommend an Amarone della Valpolicella Classico to accompany this reading, an extremely smooth red wine with low acidity, rich on the palate with a slightly nutty taste. Amarone della Valpolicella is grown north of Verona in Italy. Only the best grapes are used for this wine. After the harvest, the grapes are dried for up to four months on straw mats or wooden grids and are turned over again and again during this time. This process (appassimento) causes the grapes to lose up to 50 percent of their weight. After appassimento, the grapes are pressed. Amarone della Valpolicella Classico is available in various price categories, starting at around 20 euros per bottle. One of the top Amarones and representatives of the upper price segment is currently the Giuseppe Quintarelli Amarone della Valpolicella DOCG Classico Selezione.

But now to the gold company we would like to introduce to you today. When investing in a gold company, it is always important to find the right company. We analyse a great many gold companies and have focused in particular on undervalued companies with an independently confirmed value. The value is firstly defined in a deposit (NI 43-101 is the relevant regulation) and secondly in a value study. These are important criteria for us before we make a recommendation. The company presented below already has a confirmed value and is not yet very well known.

This company has not only fully passed in all points of the audit, but has even exceeded our expectations. In wine jargon one would say: 100 points by Parker, i.e. with exceptional character and complexity, or according to Guía Peñín 100 points - an exceptional company.

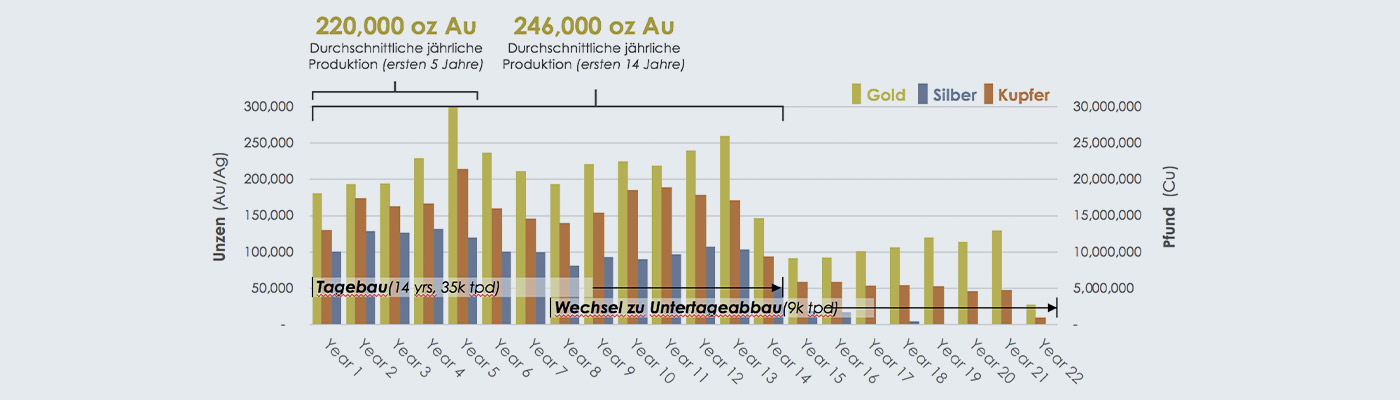

Troilus Gold Corp. is a Toronto-based resource company that was incorporated in 2017. That same year, the company acquired a historic mine. The sellers thought the mine was depleted. It had already produced 2 million ounces of gold and 70,000 pounds of copper. But this was a significant misjudgement by the sellers! Troilus Gold was able to publish a profitability study through exploration and drilling in July 2020, which confirms a pre-tax value for the company of approximately Euro 1.5 billion, based on a gold price of 1,750 dollars per ounce. At a gold price of $1,950 per ounce, the value rises to approximately Euro 1.5 billion. In a recent interview, the company's CEO, Justin Reid, reported that the upcoming Feasibility Study will show more than 10 million ounces of gold as well as gold reserves for the first time. Due to the very low market capitalisation, Troilus Gold has not only become a very promising investment for the risk-conscious investor, but also a highly attractive takeover candidate for the gold titans, who always have to replenish their gold reserves in order to maintain their own stock market valuation.

|

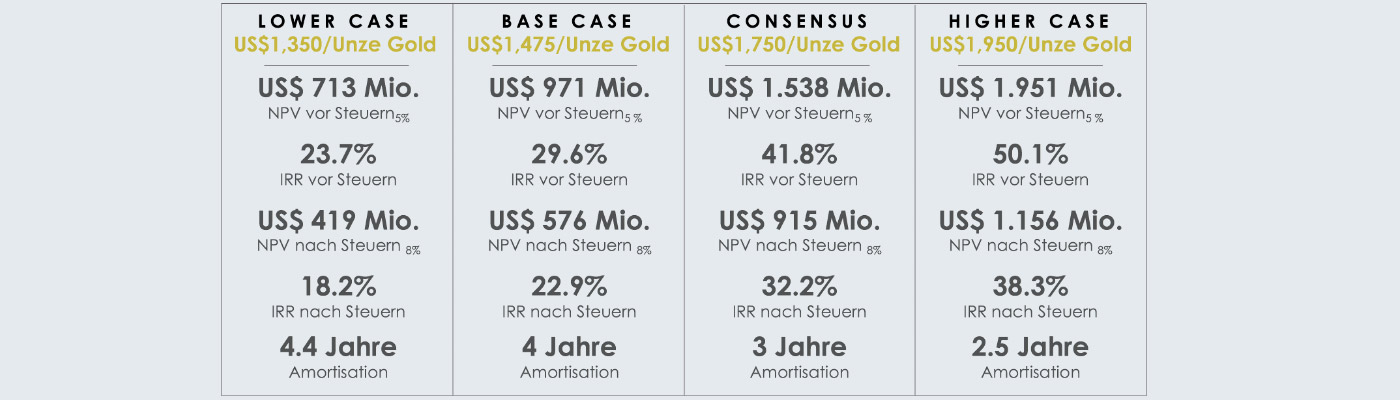

For all case studies, the gold price is decisive. We look here in particular at the "Base Case" and "Consensus" cases. In the Base Case, at a gold price of 1,475 US dollars per ounce, the company is valued at almost 1 billion dollars (all figures are in US dollars). The gold price in the Consensus Case is roughly equal to the current gold price and would mean that Troilus is currently valued at $1.5 billion. The current market capitalisation, however, is only about 80 million euros, i.e. very clearly below the valuation by the value study. We assume that the feasibility study currently in progress will highlight this once again.

|

The current price correction offers excellent entry potential. With price targets of up to 4 Euros per share, Troilus Gold is currently positioned as one of the most undervalued gold companies around. In relation to such an advanced stage of development, there is currently no other company that is so cheap. In less than two years, Troilus Gold plans to begin construction of the production facility and then start production. The current correction in the price of gold has made many gold companies an undervalued company and therefore an investment target. Therefore, many of the big gold companies are also on a buying spree again. In order to maintain their own share price and thus their market capitalisation, the mined gold ounces have to be replenished. We would not be surprised if Troilus also received a takeover bid. Based only on the various research reports, Troilus Gold is, from today's perspective, a "tenbagger". The undervaluation of Troilus Gold is already very glaring. Therefore, Troilus Gold Corp. is our top pick! (WKN A2JA0J)

Troilus Gold has found a great many more gold bearing strata due to the incredible metres drilled per month since the first value study in 2020 (between 12,000 and 15,000 each month). Just recently, another gold deposit was discovered, this time with extremely rich gold structures (see press releases). In order to better define this potentially significant zone, the company has decided to skip the planned Pre-Feasibility Study and focus directly on a Definitive Feasibility Study, which is expected by the middle or second half of 2023. The new, recently discovered near-surface and high grade mineralisation slab has been defined at the boundary of the previous PEA pit Z87, which is not included in the August 2020 PEA, nor was it previously considered to be part of the originally planned preliminary feasibility work. Of the four reported highlight intercepts, two are near surface and two are further downhole. Near-surface holes 87-411 and 87-410 returned 2.52 grams of gold equivalent per tonne over 25 metres, starting at 54 metres, including 12.36 grams of gold equivalent per tonne over 3 metres and 3.15 grams per tonne over 6 metres, and 2.04 grams of gold equivalent per tonne over 17 metres, starting at 22 metres depth, including 4.95 grams per tonne over 5 metres. At depth, hole 87-417 intersected the best interval drilled at the project with 154.27 grams gold equivalent over 1 metre, within a larger capacity of 4.38 grams per tonne over 46 metres. Hole 87-416 intersected 1.28 grams per tonne over 61.6 metres, confirming consistent mineralisation at depth beyond the PEA shells. This new slab to the west of Z87 has been noted to date over a strike length of 300 metres and remains open at depth and towards the Gap Zone.

.jpg) |

Learn more about Troilus Gold Corp.

Information in the original English version, as well as a virtual tour of the Troilus Mine, all press releases can be found at www.troilusgold.com.

All terms and conditions of the Legal notice and disclaimer on www.rohstoffpower.de.